President Trump consistently states or implies that countries outside of the U.S. are responsible for paying his tariffs to the U.S. Government. This is backwards. When the U.S. levies a tariff on another country, this is a tax on the American importer of the foreign good from the tariffed country.

For example, let’s say I’m a watch dealer based in the U.S. who imports watches from Switzerland for $1,000 each. And let’s say that, like Christopher Ward, I mark those watches up by three times what I pay for them. That means I sell these watches at $3,000 each and make a profit that’s 200 percent above cost.

Now, along comes a 39 percent tariff. Suddenly, my cost to import those watches has increased from $1,000 to $1,390 each. In order to maintain my profits at 200 percent above cost, I’ll be charging $4,170 per watch — an increase of $1,170, or 39 percent.

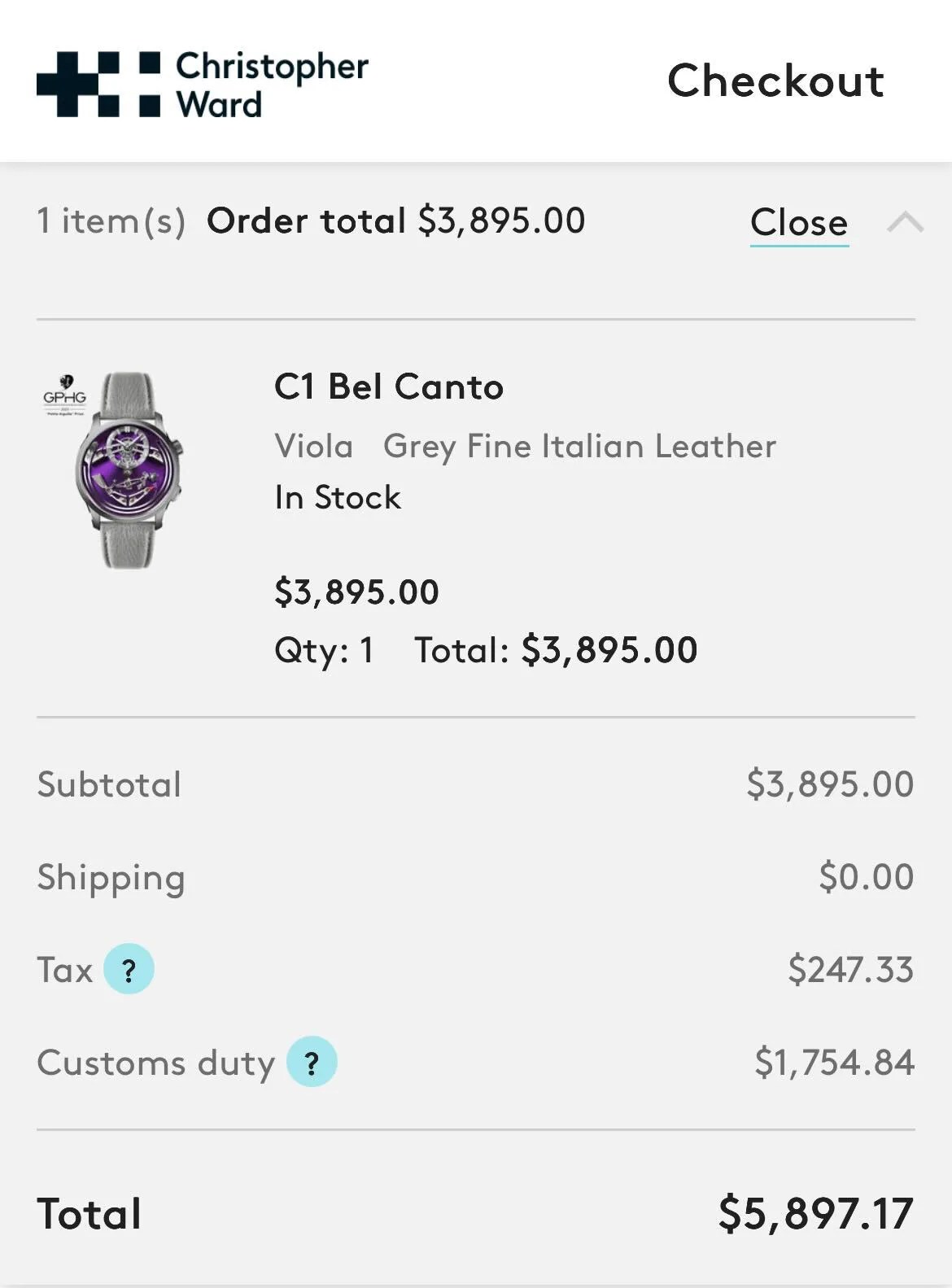

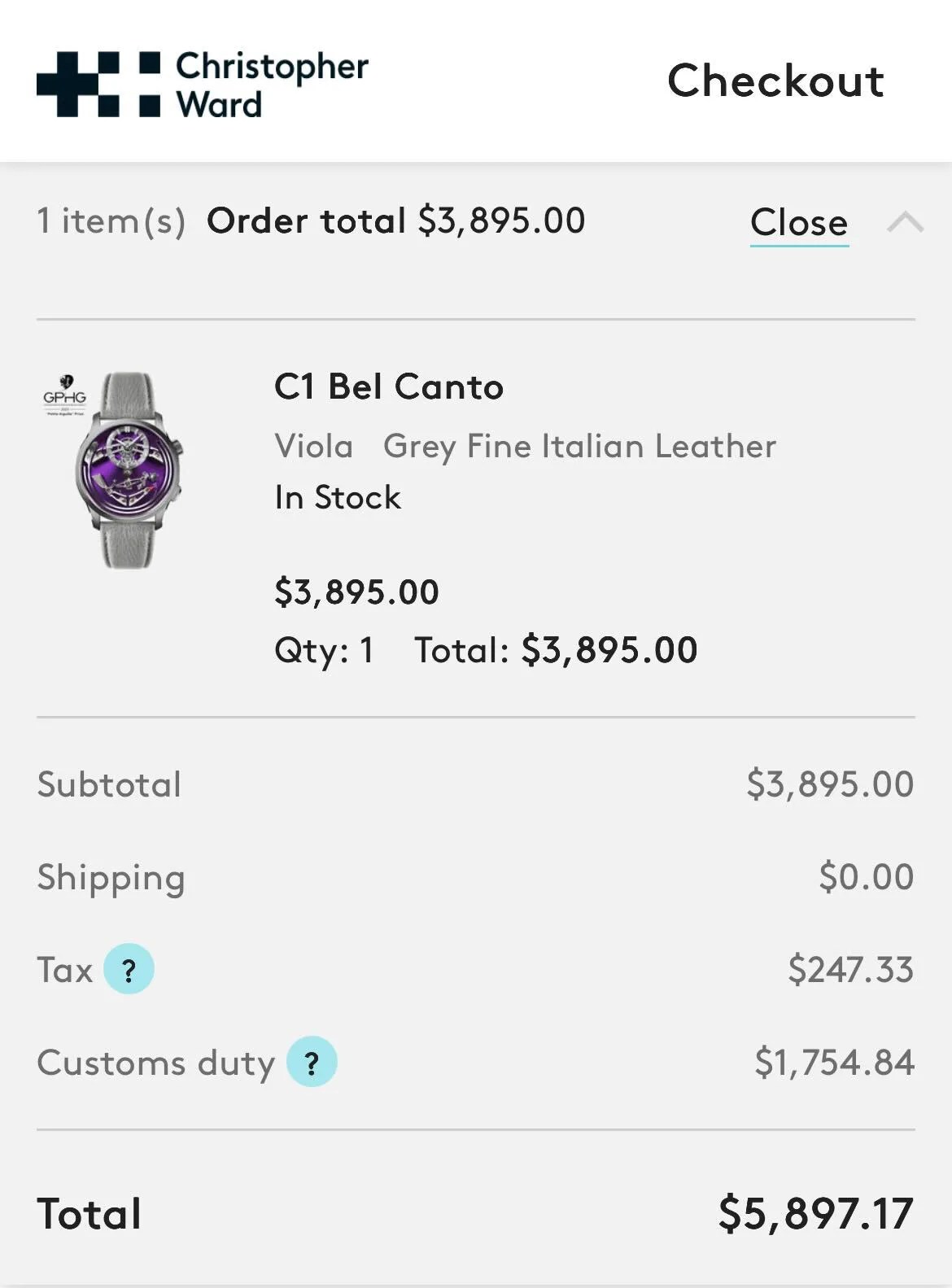

To illustrate what this looks like on some real watches, I played around on CW’s website. The Bel Canto with a Fine Leather Strap retails for $3,895, making the flagship chiming watch one of the pricier pieces offered by Ward, but it’s still very affordable for what you’re getting. After entering my address and proceeding through checkout, you’ll see a customs duty charge of $1,754.84, which, along with the Connecticut sales tax of $247.33, brings the new total to $5,897.17 — nearly $6,000.

OK, let’s try it with a dive watch. How about the classic Trident Pro 300? It’s a mere $1,095 on a bracelet — a crazy bargain. We have our CT tax of $69.53 and a customs duty of … $529.28, for a total price of $1,693.81. Decidedly less of a bargain.